nassau county sales tax rate 2020

Adina Genn May 18 2020. Some cities and local.

How To Calculate New York Sales Tax 14 Steps With Pictures

This is the total of state county.

. The average cumulative sales tax rate between all of them is 7. On March 23 2020 the Nassau County Legislature passed the Reassessment Phase-In Act of 2020. The minimum combined 2022 sales tax rate for Nassau County New York is.

The December 2020 total local sales tax rate was also 8625. A full list of these can be found below. State Local Sales Tax Rates As of January 1 2020.

Ad Find Out Sales Tax Rates For Free. The minimum combined 2022 sales tax rate for Nassau County Florida is. The latest sales tax rate for Nassau County NY.

The latest sales tax rate for Nassau County FL. This rate includes any state county city and local sales taxes. The tax reassessment affects 400000 residential and commercial properties in Nassau County.

Fast Easy Tax Solutions. 2020 rates included for use while preparing your income tax deduction. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc.

The sales tax rate for Nassau County was updated for the 2020 tax year this. Queens New York sales tax rate details The minimum combined 2021 sales tax rate for Queens New York is 888. The sales tax rate for Nassau County was updated for the 2020.

375 is earmarked for the Metropolitan Transportation Authority. The Nassau County Sales Tax is collected by the merchant on all qualifying sales made. How much is sales tax in Nassau County in New York.

The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total. How much is NY Sales Tax 2020. Nassau County Annual Tax Lien Sale - 2022.

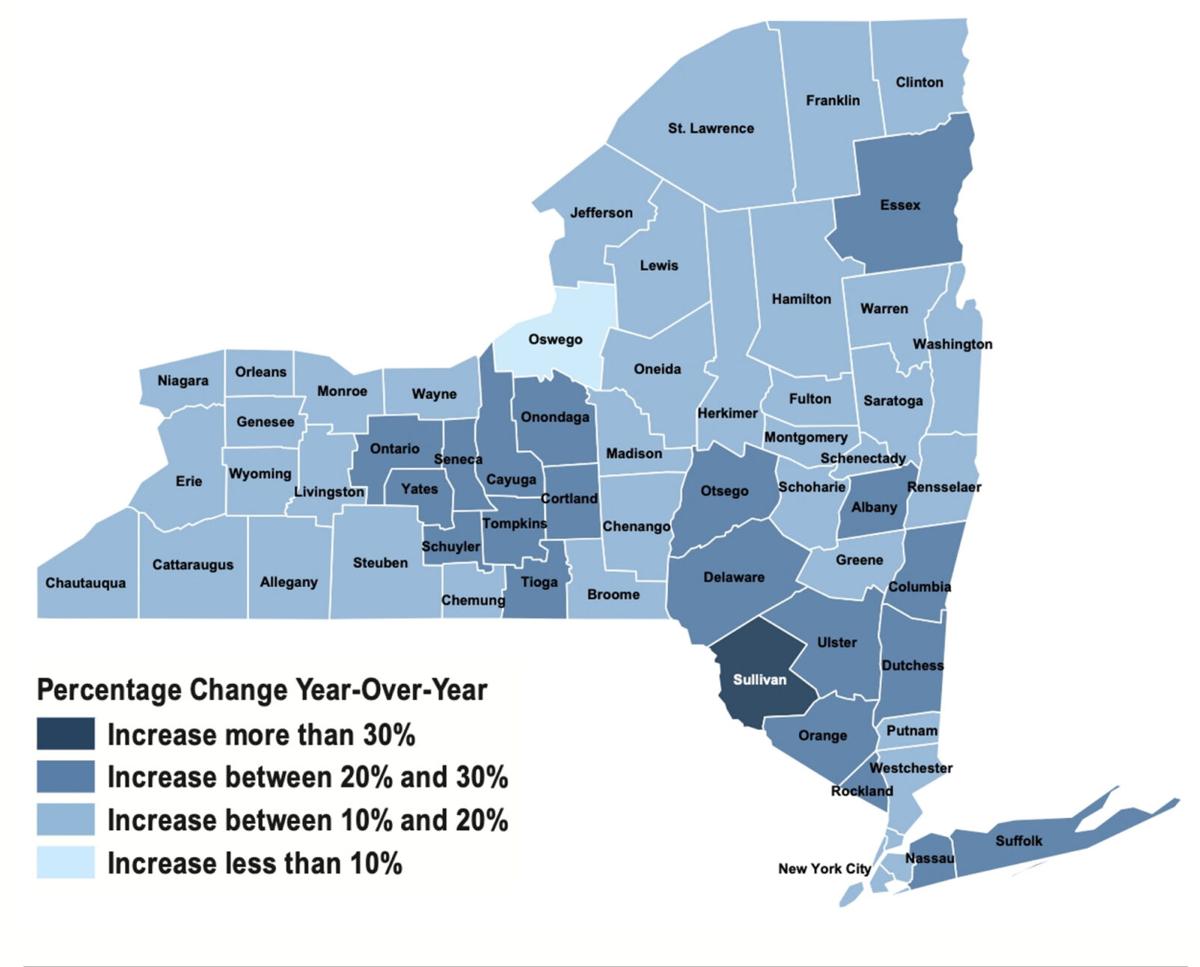

Office of the Nassau County Comptroller. Amid the COVID-19 pandemic sales tax revenue in Nassau County could drop 12 percent to 28 percent officials said Monday. 74 rows The New York sales tax of 4 applies countywide.

Taxing jurisdiction Tax rate Sales Tax Information Center. A City county and municipal rates vary. In addition to the state and local sales taxes on hotel occupancy a hotel unit fee in the amount of 150 per unit per day applies to hotels located in New York City.

This is the total of state and county sales tax rates. Nassau county property tax rate 2020 Thursday May 19 2022 Edit. The total sales tax rate in any given location can be broken down into state county city and special district rates.

4 which is retained by New York State. This rate includes any state county city and local sales taxes. Monroe County 4 Montgomery County 4 Nassau County 4⅝.

The minimum combined 2022 sales tax rate for Nassau County New York is. The Nassau County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Nassau County local sales taxesThe local sales tax consists of a 100 county sales. What is the sales tax in Queens NY.

View this measure last updated August 28 2019. The New York state sales tax rate is currently. Sales tax in Nassau County New York is currently 863.

The Sales Tax rate for Nassau County is 865. This is the total of state and county sales tax rates. The most populous location in Nassau County Florida is Fernandina Beach.

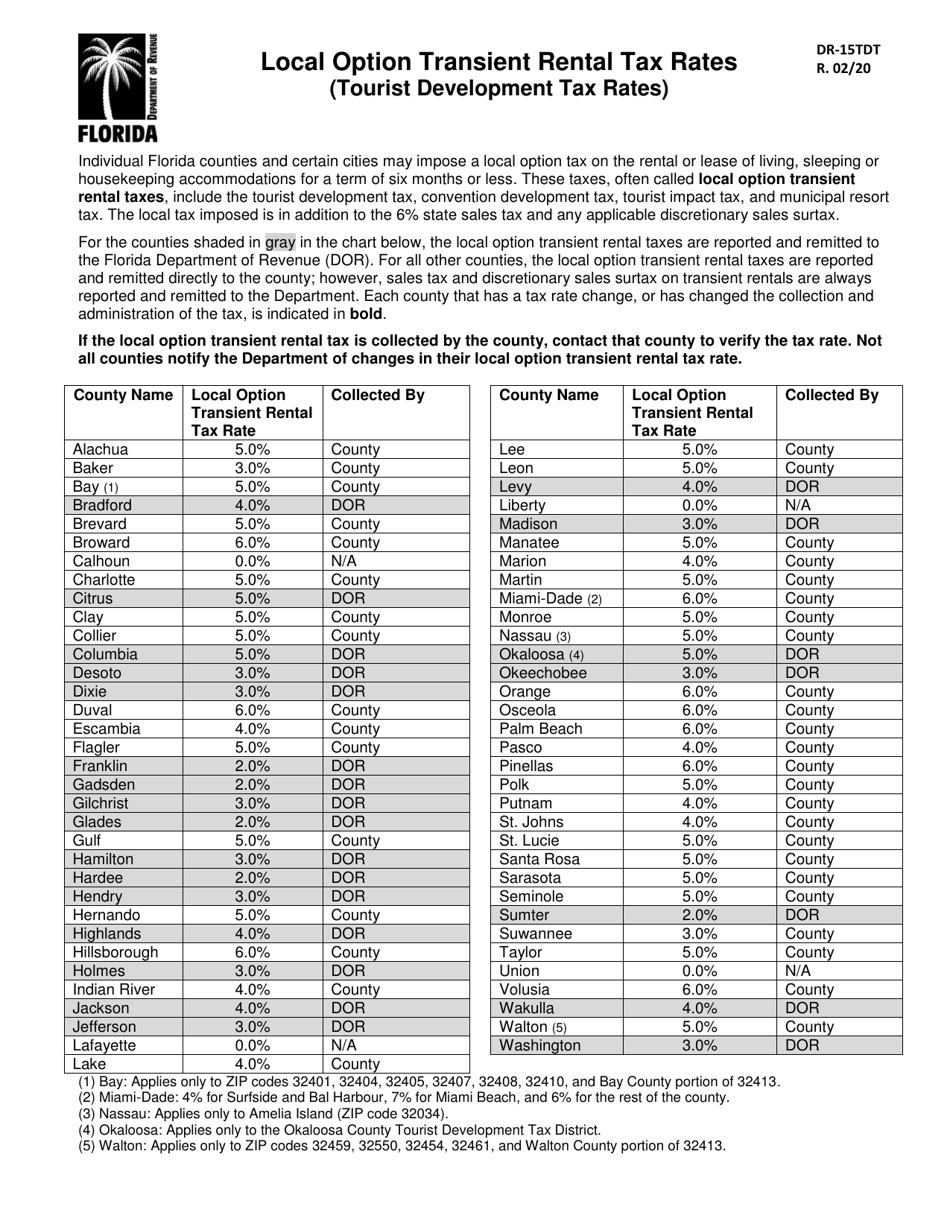

What is the sales tax rate in Nassau County. The Department of Assessment is responsible for developing fair and equitable assessments for all residential and commercial properties in Nassau County on an annual basis. Florida has a 6 sales tax and Nassau County collects an additional 1.

On February 15 th. These rates are weighted by population to compute an average local tax. Due to the postponement of last years sale in response to the COVID-19 pandemic this sale will contain unpaid taxes from.

The Nassau County Sales Tax is collected by the merchant on all qualifying sales made within Nassau County. 518-485-2889 To order forms and publications. This consists of three components.

2020 rates included for use while preparing your income tax deduction.

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com

How To Calculate Sales Tax For Your Online Store

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Commissioners Moving Forward On 1 Cent Sales Tax Referendum For St Johns County

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Form Dr 15tdt Download Printable Pdf Or Fill Online Local Option Transient Rental Tax Rates Tourist Development Tax Rates Florida Templateroller

How To Calculate Sales Tax For Your Online Store

Us Homes Are Now More Valuable Than Ever House Prices Real Estate Redfin

File Sales Tax By County Webp Wikimedia Commons

Florida Sales Tax Rates By City County 2022

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Is New York S Sales Tax Discover The New York Sales Tax Rate In 62 Counties

How To Calculate Sales Tax Video Lesson Transcript Study Com

Florida Sales Tax Small Business Guide Truic

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates